If you lose your home to foreclosure and the house sells for more than you owe, you might get to keep that money. Find out how to claim surplus funds from a foreclosure.

If you default on your mortgage payments, the lender will likely foreclose. A "foreclosure" is the legal process in which a home loan lender sells a property at auction to pay off the remaining mortgage balance. The foreclosure process ends with an auction (a "foreclosure sale").

When a foreclosure sale results in surplus funds—that is, money over and above what's needed to pay off all the liens on the property, including the mortgage—this extra money belongs to you (the homeowner), not the foreclosing lender.

- How Foreclosure Sales Work

- What Are Foreclosure Surplus Funds?

- Who Gets Foreclosure Surplus Funds?

- How to Find Out If Your Foreclosure Resulted in Excess Proceeds

- How Much Time Do I Get to Claim Surplus Funds?

- What Is the Process for Claiming Surplus Funds After a Foreclosure?

- What Happens If I Don't Claim Foreclosure Surplus Funds?

- What Are the Common Mistakes People Make When Claiming Foreclosure Surplus Funds?

- How Long Will It Take to Receive Surplus Funds?

- What Should I Do If I Need Help Claiming Surplus Funds After a Foreclosure?

How Foreclosure Sales Work

Around 120 days after you stop making your mortgage payments, the lender will likely begin a foreclosure. The process will be either judicial (through the state courts) or nonjudicial (where the lender must complete a series of out-of-court steps, like mailing a notice of foreclosure and publishing it). After the lender completes all necessary foreclosure procedures, the home is sold to a new owner at a foreclosure sale.

Typically, a sale date is set, and the property is advertised for sale, usually on a local website, in newspapers, or through notices at the property. As the final step in the foreclosure process, a trustee or an officer of the court, like the sheriff, conducts the foreclosure sale. (However, in two states, Connecticut and Vermont, a judge who approves a foreclosure can give the home's title directly to the lender.)

Foreclosure sales are auctions, which are open to the public. Both private buyers and the foreclosing lender may bid on the property at the sale. The foreclosing lender bids first, using a "credit bid." (With a credit bid, the lender gets a credit in the amount of the mortgage debt, effectively buying back the home if no higher offers are made.) The lender might bid the full amount the mortgage borrower owes, including foreclosure fees and costs, or it might bid less.

After the lender bids, another person or entity, such as a real estate investor or another third party, can submit a higher bid and potentially win the auction. The bidding will continue until no one makes a higher bid than the last one.

What Are Foreclosure Surplus Funds?

Sometimes, a property in the final stage of foreclosure sells at the foreclosure sale for more than the borrower owes on the mortgage loan. (In other cases, the property sells for less than the borrower's total debt, resulting in a "deficiency," see below.)

If the purchase price at the foreclosure sale exceeds the borrower's loan balance, this extra amount is called "excess proceeds," an "overage," or "surplus funds." This amount consists of the remaining balance after paying off the mortgage debt, fees, and foreclosure-related costs.

After a foreclosure, any surplus funds are distributed to lienholders and then to the foreclosed homeowner. But you must follow specific procedures, which vary from place to place, to claim surplus funds. If these monies go unclaimed, the surplus funds might go to the state or other designated parties after a certain period.

How Do Surplus Funds Occur?

Again, if the highest bidder at the foreclosure sale pays more than you owe on your mortgage loan, the overage is called "surplus funds."

How Are Surplus Funds Calculated?

For example, say your home sells to a new owner at a foreclosure sale for $450,000. You owe the foreclosing lender $425,000. The additional $25,000 is surplus funds.

How Surplus Funds Are Held After a Foreclosure Sale

Depending on the circumstances, the foreclosure trustee or other person handling the foreclosure sale usually distributes the overage or deposits surplus funds with the local court clerk.

Who Gets Foreclosure Surplus Funds?

Remember, if a foreclosure sale results in excess proceeds, the lender doesn't get to keep that money. The lender is entitled to an amount sufficient to pay off the outstanding balance of the loan plus the costs associated with the foreclosure and sale—but no more.

The laws that govern how foreclosure surplus funds are handled vary from jurisdiction to jurisdiction. State law generally says how surplus funds get distributed. Understanding the distribution and the process for claiming surplus funds if you're entitled to them after a foreclosure is crucial because it can mean the difference between walking away from a foreclosure with some money in your pocket (perhaps a substantial amount) or forfeiting the overage.

Surplus funds usually get distributed first to subordinate lienholders in order of priority and then to the former homeowners (borrowers). So, you might have the right to claim the surplus funds after your house is foreclosed, particularly if you don't have any other liens on your home. The surplus funds represent the equity you've built up in your home. But these funds won't automatically be sent to you. You must follow a specific claim process within certain timing requirements.

What Happens to Surplus Funds If You Have a Second Mortgage or Other Liens on Your Home

Generally, if any junior liens were on the home, like a second mortgage, HELOC, or a creditor recorded a judgment lien against the property, those parties get the first crack at the surplus funds before the homeowner can get them. Any excess proceeds left over after paying off these liens belong to the former homeowner.

For example, Jack and Georgia go through a foreclosure. At the foreclosure sale, their home sells for $550,000. The loan balance they owed the foreclosing lender at that time was $525,000. So, the sale resulted in surplus funds of $25,000. The property was also subject to a second mortgage of $15,000. In addition, a credit card company got a $5,000 judgment lien on their home after it filed a lawsuit against Jack and Georgia for a money judgment and won. In this situation, $525,000 goes to the foreclosing lender, $15,000 goes to the second mortgage holder, and $5,000 to the judgment creditor. Jack and Georgia can claim the $5,000 overage that remains.

However, depending on the situation, a junior lienholder or foreclosed homeowner could lose their rights to the excess proceeds if they don't respond to judicial foreclosure proceedings or follow the correct procedures for claiming the surplus.

Deficiency After a Foreclosure Sale (When There's No Surplus Funds)

On the other hand, if your property is foreclosed and sells for less than you owe, again, the unpaid portion of the mortgage loan is called a "deficiency." Depending on state law and the situation, the lender might be able to get a deficiency judgment against you for this amount.

You might also remain responsible for paying the debts associated with any liens that were foreclosed, but didn't get any money from the foreclosure sale.

How to Find Out If Your Foreclosure Resulted in Excess Proceeds

Typically, if a foreclosure sale has surplus funds, the trustee or other sale officer must send a notice to the foreclosed homeowner's last known address. But the last known address is usually the foreclosed property.

Because most people don't realize they're due any excess proceeds, they tend to vacate a foreclosed property without leaving a forwarding address. Then, they might not receive important notices about the distribution of foreclosure proceeds.

So, you should monitor the foreclosure process to find out if the sale generates excess proceeds. You can also contact the officer or trustee who conducts the sale after the sale takes place.

Track the Foreclosure Process to Learn About Surplus Funds

Because you don't know whether a foreclosure sale will generate surplus funds, it's a good idea to track the foreclosure process as it goes along. Take note of the foreclosure sale date, which will be in the foreclosure documents you receive.

After the auction, contact the trustee or officer who sold the property. This information, including the trustee or officer's name and phone number, should also be in the paperwork you received during the foreclosure and in your local newspaper's legal section where the sale notice was published. Call your loan servicer if you can't figure out who conducted the sale or how to contact that person.

Then, ask the trustee or officer if the auction resulted in excess proceeds.

What to Do If the Sale Generated Excess Proceeds

If the sale has surplus funds, give the trustee or officer your new address. Follow up with a letter sent by certified mail, return receipt requested, and regular mail, including your new address and contact information.

Also, when you call the trustee or sale officer, ask what you need to do to claim your share of the proceeds.

How Much Time Do I Get to Claim Surplus Funds?

You (the foreclosed homeowner) must make a claim to get your share of surplus funds from a foreclosure. You'll need to act quickly to claim surplus funds after the foreclosure sale. A limited amount of time will be available for you to get the funds. The exact amount of time you'll have depends on state procedures.

What Is the Process for Claiming Surplus Funds After a Foreclosure?

You can apply to either the foreclosure trustee or the court to get the foreclosure excess proceeds. The procedures for distributing and claiming surplus funds after a foreclosure sale vary depending on whether the foreclosure was judicial or nonjudicial and differ from state to state and even from county to county.

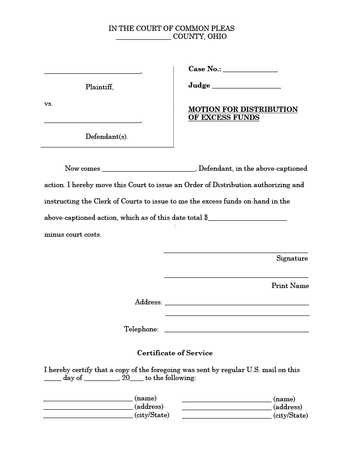

In some cases, claiming surplus funds through official channels is easy. You'll probably have to fill out an application, or form or file a motion in court, or follow some other specific procedures. (For example, in some Ohio counties, you'd file a motion similar to the sample "Motion for Distribution of Excess Funds" shown here. You can get help with this motion on the Ohio Legal Help website. Be sure to check with your county for specific instructions and requirements. The particular form or paperwork you'll need to file and the exact procedures you must follow will likely be different than this sample.)

You might have to serve the paperwork on all parties to the foreclosure. Or you might have to cite the legal authority that gives you the right to get the surplus funds or that you were the homeowner or mortgage debtor at the time of the foreclosure sale. Again, different states and different counties have their own requirements. Call the court or trustee that handled the foreclosure process to find out the precise procedures you need to follow. They might refer to the excess amount as an "overbid" or "overage." You might also receive instructions about claiming surplus funds in a legal notice.

Sometimes, the process of claiming surplus funds can be confusing for homeowners, especially after the stress of going through a foreclosure. Talk to a lawyer if you need help getting the excess money following a foreclosure.

What Happens If I Don't Claim Foreclosure Surplus Funds?

It's your responsibility to claim surplus funds after a foreclosure; the court or foreclosure trustee won't come looking for you to give you the excess money.

What happens to unclaimed surplus funds from a foreclosure sale depends on the specific laws and regulations in the jurisdiction where the sale happened. Usually, unclaimed surplus funds go to the state's unclaimed property division. You might still be able to access the funds if you find yourself in this situation.

If you've missed the deadline for claiming surplus funds, consult with a lawyer immediately. They might be able to help you navigate the process and potentially recover the funds even if the initial deadline has passed.

What Are the Common Mistakes People Make When Claiming Foreclosure Surplus Funds?

Here are a few typical mistakes people make when claiming foreclosure surplus funds.

Failing to Act Quickly

If you don't act quickly, you could miss the deadline to claim the funds. The time limit varies depending on the jurisdiction.

Falling for Scams

Scammers sometimes try to coerce foreclosed homeowners into signing away their rights to surplus funds, or they charge high fees to help with the process (see below). If you need help, contact an attorney.

Failing to Claim Surplus Funds

Homeowners often don't claim surplus funds because they aren't aware of them. Be sure to find out if the foreclosure sale in your case results in an overage. Again, you can verify whether a foreclosure sale results in surplus funds by contacting the foreclosure trustee or court officer who oversaw the sale. Also, be sure to provide a forwarding address when you move out of a foreclosed property to increase your chances of getting notifications about surplus funds.

Not Following the Proper Procedures

If you submit the wrong paperwork or include incorrect or incomplete information, you might not get the surplus funds. Be sure you have the correct documentation, and you fill out the forms correctly. Also, attend a court hearing if necessary to prove your right to the surplus funds.

How Long Will It Take to Receive Surplus Funds?

Exactly how long it will take for you to receive surplus funds after applying for them varies, depending on the jurisdiction and circumstances. For example, it could take longer if someone else claims they have the right to the excess proceeds. Local workloads and procedures can also be a factor in how fast surplus funds are dispensed.

Generally, surplus funds are distributed in 30 to 120 days. But it could take more or less time, depending on the circumstances.

What Should I Do If I Need Help Claiming Surplus Funds After a Foreclosure?

Again, if you need assistance with claiming surplus funds after a foreclosure, talk to an attorney. Foreclosure lawyers often handle surplus funds claims, ensuring that foreclosed homeowners recover the money they're entitled to following a foreclosure sale. Having a lawyer assist with the process can increase the likelihood that there won't be any errors or delays in the claim process. If you can't afford to hire a lawyer, you might qualify for free assistance from a local legal aid office.

However, beware of private companies offering to help guide you through the process of claiming surplus funds. You might get a letter or a call from a company saying it will help you claim any surplus funds after you go through a foreclosure. These communications are typically from for-profit companies or individuals with no legal training. But they'll claim they can locate excess proceeds and distribute them to you for a fee. These companies tend to be predatory and aren't affiliated with the court, trustee, or the lender. It's best to avoid dealing with them.

Downsides to Using a Private Company to Help You Claim Surplus Funds After a Foreclosure

Scammers review foreclosure notices and know when a foreclosure sale has resulted in surplus funds. Using a private company to claim surplus funds can be risky and costly. These companies charge high fees and might use predatory tactics. Here are a few of the downsides to using a private company to claim the overage after a foreclosure:

- Potential for fraud. Some companies attempt to defraud the court and those entitled to surplus funds by making false claims about who should get surplus funds. Other companies trick former homeowners into signing away their rights to the surplus funds.

- Unnecessary (and high) fees. These third-party companies often charge high fees for services that homeowners can typically perform themselves or with the help of a lawyer. Be especially wary of any company that charges upfront fees.

- Predatory tactics. Third-party companies aren't connected to the court, trustee, or lender, but they might claim to be official. They might also use aggressive tactics. Legitimate companies don't use high-pressure sales techniques or demand immediate action.

- Lack of legal expertise. Most private companies offering to help foreclosed homeowners access surplus funds don't have proper legal training or knowledge of local laws and procedures.

- Delayed access to funds. Using a private company can potentially slow the process of receiving your surplus funds. The company might not follow the correct procedures or might fill out the paperwork incorrectly. Or they might take your money and then fail to file the proper paperwork at all.

- Missing deadlines. A private company might miss the cutoff date for claiming your surplus funds, making it harder, if not impossible, for you to get them.

If you need help getting the surplus funds, contact an experienced local attorney, a legal aid office, or the foreclosure trustee or court directly.

- How Foreclosure Sales Work

- What Are Foreclosure Surplus Funds?

- Who Gets Foreclosure Surplus Funds?

- How to Find Out If Your Foreclosure Resulted in Excess Proceeds

- How Much Time Do I Get to Claim Surplus Funds?

- What Is the Process for Claiming Surplus Funds After a Foreclosure?

- What Happens If I Don’t Claim Foreclosure Surplus Funds?

- What Are the Common Mistakes People Make When Claiming Foreclosure Surplus Funds?

- How Long Will It Take to Receive Surplus Funds?

- What Should I Do If I Need Help Claiming Surplus Funds After a Foreclosure?