What is a Limited Liability Company?

Frequently asked questions about starting and running an LLC, or limited liability company.

If you have a business idea that you want to put into action, you'll need to choose a business structure. Many small business owners choose to create a limited liability company (LLC). An LLC has many advantages, including limited liability protection for owners, a flexible management structure, and tax benefits.

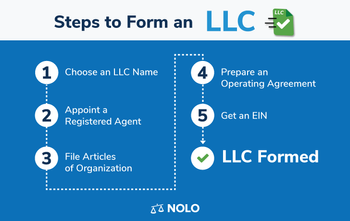

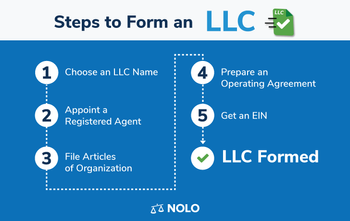

Follow these steps to create an LLC in Montana. For more information on how to form an LLC in any state, see our article on how to start an LLC. You can also use our online LLC formation service to register your LLC.

As you start forming your LLC, you'll need to pick a business name. When choosing a name, make sure you follow Montana's laws for naming LLCs.

LLC name must be distinguishable. Your LLC's name must be distinguishable (different) from the names of any corporations, LLCs, limited partnerships, and any assumed names, or trademarks on file with the Montana Secretary of State (SOS). You can check to see whether your proposed name is available on the SOS's business name database. (Mo. Rev. Stat. § 35-8-103 (2024).)

LLC name must include an entity designator. Under Montana law, your LLC name must contain the words "limited liability company" or "limited company" or the abbreviations "LLC," "LC," "L.L.C.," or "L.C." In addition, you can abbreviate the words "limited" and "company" to "ltd." and "co.," respectively. (Mo. Rev. Stat. § 35-8-103 (2024).)

Name reservation. You can reserve an available business name for 120 days by filing a Reservation of Name with the SOS. You can reserve an LLC name online through the SOS's Online Filing Portal. You can't renew the reservation. As of 2024, the filing fee to reserve a name is $10. (Mo. Rev. Stat. § 35-8-104 (2024).)

Using an assumed business name. You can do business under a name that's different from your LLC's legal name listed in its articles of organization. This alternative name is sometimes called a "trade name," "DBA" (short for doing business as), or "fictitious business name." If your LLC uses an assumed name, you must register it with the SOS. File a Registration of Assumed Business Name (ABN/DBA) with the SOS to reserve your LLC name. You can file the form online through the SOS's Online Filing Portal. As of 2024, the fee to reserve an assumed business name in Montana is $20. (Mo. Rev. Stat. §§ 30-13-201 and following (2024).)

See the SOS's Business Help Center for detailed information about business names.

Every Montana LLC must have an agent for service of process (called a "registered agent") in the the state. An agent's role is to accept legal papers on a company's behalf and forward the documents to the represented entity.

In Montana, an LLC can use either a:

A commercial registered agent is a person or business that's filed a commercial registered agent listing statement with the SOS. They must maintain basic information about themselves with the SOS, including their name, business address, and entity type. In either case, your registered agent must have a physical street address in Montana. Montana has a list of registered agents you can check.

(Mo. Rev. Stat. §§ 35-7-101 and following (2024).)

As long as you meet the registered agent legal requirements, you can act as your own registered agent.

You create a Montana LLC is created by filing Articles of Organization with the SOS. The articles must include:

(Mo. Rev. Stat. §§ 35-8-201 and 202 (2024).)

You must file the articles online with the SOS via the SOS's Online Filing Portal. As of 2024, the filing fee for Montana articles of organization is $35.

In Montana, members of an LLC can, but don't have to, create an operating agreement to govern the LLC. While an agreement isn't required, it's highly recommended your LLC create one. You should put this important organizational document in writing—but Montana doesn't require LLCs to be in writing to be effective. (Mo. Rev. Stat. § 35-8-104 (2024).)

An operating agreement should generally cover:

An operating agreement is important for several reasons. It can help preserve your limited liability by showing that your LLC is truly a separate business entity. In addition, investors and banks typically like to see an LLC's operating agreement when determining whether to invest or loan money to the company. Moreover, the operating agreement ensures that all current and future members and managers are on the same page about the LLC's operations.

In the absence of an operating agreement, state LLC law will govern how your LLC operates.

For help creating an LLC operating agreement, you can use our online LLC formation service.

Other tax and regulatory requirements might apply to your LLC. These additional requirements can include the following.

EIN. If your LLC has more than one member, it must obtain a federal employer identification number (EIN), even if it has no employees. If you form a single-member LLC, you must obtain an EIN for your LLC only if you'll have employees or you elect to have your LLC taxed as a corporation instead of a sole proprietorship (disregarded entity). You can obtain an EIN by completing an online EIN application on the IRS website. There's no filing fee.

Business licenses. Depending on your LLC's business activities and location, your LLC could need to obtain other local and state business licenses. In general, the state governs professional licenses while the cities and counties govern all other business licenses. For local licenses, check with the clerk for the city where the LLC's primary place of business is located (or county if it's in an unincorporated area). For state license information, visit the small business licensing information section of the Montana Department of Commerce (DOC) website.

Montana Department of Revenue. In some cases, for example, if you have employees or will be selling goods and collecting sales tax, you'll need to register with the Montana Department of Revenue (DOR). You can register for various types of taxes for your business through TransAction Portal (TAP) or with Form GenReg. See the taxes section of the DOR website for more details on various income and business taxes.

Here are some other questions you might have about your Montana LLC.

If you're just starting your business or have already been operating as a sole proprietor, you should consider forming an LLC. LLCs limit an owner's personal liability for business debts and lawsuits and offer a lot of flexibility when it comes to ownership, management, and taxation of the business.

To learn more about LLCs and decide if it's the right business structure for you, see our article on LLC basics.

Below are the fees (as of 2024) you might need to pay to form your LLC in Montana:

Filing on your own is often the cheapest option, but completing all of the forms and filing them yourself can be complicated. Hiring a lawyer is another option, but it will often cost you hundreds, if not thousands, of dollars in the process. If you'd like help completing all the filings, try our online LLC formation service.

To learn more about the costs associated with forming and running an LLC, see our article on how much it costs to form an LLC.

Your LLC must file an annual report to stay in good standing with the SOS. The report is due each year between January 1 and April 15. The SOS can administratively dissolve your LLC if you fail to file your report or pay any fees that are due. (Mo. Rev. Stat. §§ 35-8-208 and 209 (2024).)

The annual report fee is waived for 2024 and 2025. You can file your report online through the SOS's Online Filing System.

If you have a foreign LLC (located outside Montana), you must file your annual report by November 1 or your Certificate of Authority will be involuntarily revoked with no possibility of reinstatement. You'd need to register again to do business in Montana.

Apart from annual reports, your LLC will need to file and pay applicable taxes to the local, state, and federal governments. In addition, your LLC might need to obtain and periodically renew any required general or special business licenses or permits. You'll be responsible for keeping track of these maintenance requirements to keep your LLC in good standing and legally compliant.

Starting in 2024, all LLCs were previously required to submit a beneficial ownership information (BOI) report to the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of Treasury. However, in March 2025, after some constitutional challenges, FinCEN revised the BOI reporting rule so that the requirement only applies to companies created outside the U.S. So, if you form your LLC within the U.S., then you no longer need to worry about the BOI reporting requirement.

You're not required to have an operating agreement in Montana. Though, it's highly advisable to have one. An operating agreement can help protect your limited liability status, prevent financial and managerial misunderstandings among members, and ensure that you choose the rules that govern your business instead of your state's default rules.

Depending on its business activities and location, your LLC might need to obtain other local and state business licenses. For local licenses, check with the clerk for the city where the LLC's primary place of business is located (or county if it is in an unincorporated area). For state license information, check the Montana Governor's Office of Economic Development Business Checklist.

In some cases, for example, if you have employees, you'll need to register with the DOR. For most registration purposes, you must register online using TAP.

Yes. A foreign (out-of-state) LLC must register with the SOS to do business within the state. It must appoint an agent for service of process located in Montana. To register, file a Certificate of Authority for Foreign Limited Liability Company online with the SOS using the SOS's Online Filing Portal. As of 2024, the filing fee for a certificate of registration is $70.

Before filing, make sure the LLC's name is available in Montana by checking the Montana business name database. If the name isn't available, the foreign LLC must adopt an assumed name for use in Montana. To do so, register your assumed name with the SOS.

(Mo. Rev. Stat. §§ 35-8-1001 and following (2024).)

See our guide to qualifying to do business outside your state for more information.

Yes. For most formation purposes, a Montana single-member LLC is considered the same as a multi-member LLC. The steps to form a single-member LLC in Montana are generally the same as those listed above.

Single-member LLCs do have additional flexibility when it comes to filing a tax return. To learn more, see our article on how single-member LLCs pay federal income tax.

Yes. If you provide a licensed professional service in Montana and want to form an LLC, you can form a professional LLC (PLLC). Examples of providers of professional services include architects, attorneys, dentists, certified public accountants, physicians, and more. Generally, if you provide a service that requires you to obtain a Montana state license, certification, or other legal authorization before practicing, then you provide a professional service.

You can form a professional LLC to perform professional services or services ancillary to the professional services within a single profession. However, in some cases, you can form a PLLC for a combination of professional services if allowed by licensing laws and rules in Montana.

(Mo. Rev. Stat. §§ 35-8-1301 and following (2024).)

When you're ready to close your business, you should legally dissolve your LLC to limit your liability for lawsuits and government fees. To dissolve an LLC in Montana, you should:

(Mo. Rev. Stat. §§ 35-8-901 and following (2024).)

You also need to close your tax accounts and take any other steps necessary to close out your business. See our article on what you need to do when closing your business for more in-depth information and guidance.

Montana has a lot of great resources for new business owners. To get started, check out these government resources:

You should also read our article on how to start a business in Montana. If you want personalized legal help, talk to a Montana business attorney. They can help you with your business registrations, tax and regulatory obligations, and organizational documents.

Ready to start your LLC?

Frequently asked questions about starting and running an LLC, or limited liability company.

LLC owners report business income and losses on their personal tax returns. Learn how to make the most of your LLCs tax flexibility.

Take our business formation quiz to find out what the best form of business ownership is for you.

Read about why you need an operating agreement and what to include in one.

LLCs offer their owners liability protection, but if you aren't careful an LLC's owners, members, or shareholders may be on the hook personally for business debt.

Appointing a registered agent is a simple - but essential - step for every business. Learn more about what a registered agent does.

Get all of the information you need to start and run a small business.