Freelancers and independent contractors can encourage clients to pay quickly and easily by following these invoicing practices.

Like a lot of freelancers and independent contractors, you probably started your business because you wanted to focus on the work you do, and not on attending meetings, writing reports, or any of the other tasks typically required of employees. But even those who work for themselves will find it necessary to set up some systems, and an invoicing system for getting paid is perhaps the most important.

Setting the Stage for Good Invoicing Procedures

Rather than something you do after you've completed the work, invoicing clients for payment is part and parcel of completing your assignment. The invoicing process actually begins when you and your client first agree to the assignment, and it ends when you submit an invoice for the work and receive payment. The contents of your invoice shouldn't be a surprise to your client. Done right, it should tie together all the elements you've already discussed and included in your service agreement in a way that makes it easy for your client to process and send you payment.

At the same time that you and your client discuss the work you'll do, ask the client about its payment process, including the department name and names of individuals that pay the bills. Ask if the company has preferred payment methods (such as by check or electronic funds transfer), and terms (How long does the company have to pay your invoice?) Prepare for the discussion by asking yourself and your client these questions:

Will you require a deposit? Many freelancers and independent contractors ask for an initial deposit before beginning work. Deposits are customary for some independent workers, such as general contractors, because they must hire workers (who will be paid as the job progresses), and they often incur up-front expenses like buying materials before the work starts. Many freelancers (like web developers and graphic artists) require deposits because of the time that passes between starting and completing a project. Explaining the reasons you are asking for a deposit can help build trust with your client.

What types of payments will you accept? Some types of payments might be easy for you but not for your client. It's a good idea to offer several payment options (check, credit card, payment services like PayPal, and so on), to learn your client's preferences, and accommodate them when possible. Making it easy for clients to pay you can help you get repeat business.

Who pays the invoices for your client? In some companies, the contact person a freelancer works with is not the person who pays the bills. Some companies require the person who ordered the service to approve the invoice first, and forward it to the person whose job it is to pay it. Other companies ask you to forward invoices directly to the person who pays the bills. Knowing where and to whom to send invoices will help you get paid faster and follow up if payments are late or missed.

What payment terms will you establish? Payment terms tell the client when payment is due. Some of the commonly used terms are:

- due upon receipt

- due 30 days from receipt, often written as Net 30, and

- due 60 days from receipt, often written as Net 60.

Your industry might customarily use a particular term of payment, such as 30 days, but you can also set your payment terms based on your own needs. You should also decide whether you want to offer incentives for early payment. For example, you might require payment 30 days from receipt of the invoice, but offer a small discount if payment is made within 15 days. You'll also want to decide whether to charge a late fee if payment is late. Letting your client know your terms at the outset will help you avoid problems and delays in getting paid.

How to Write an Invoice

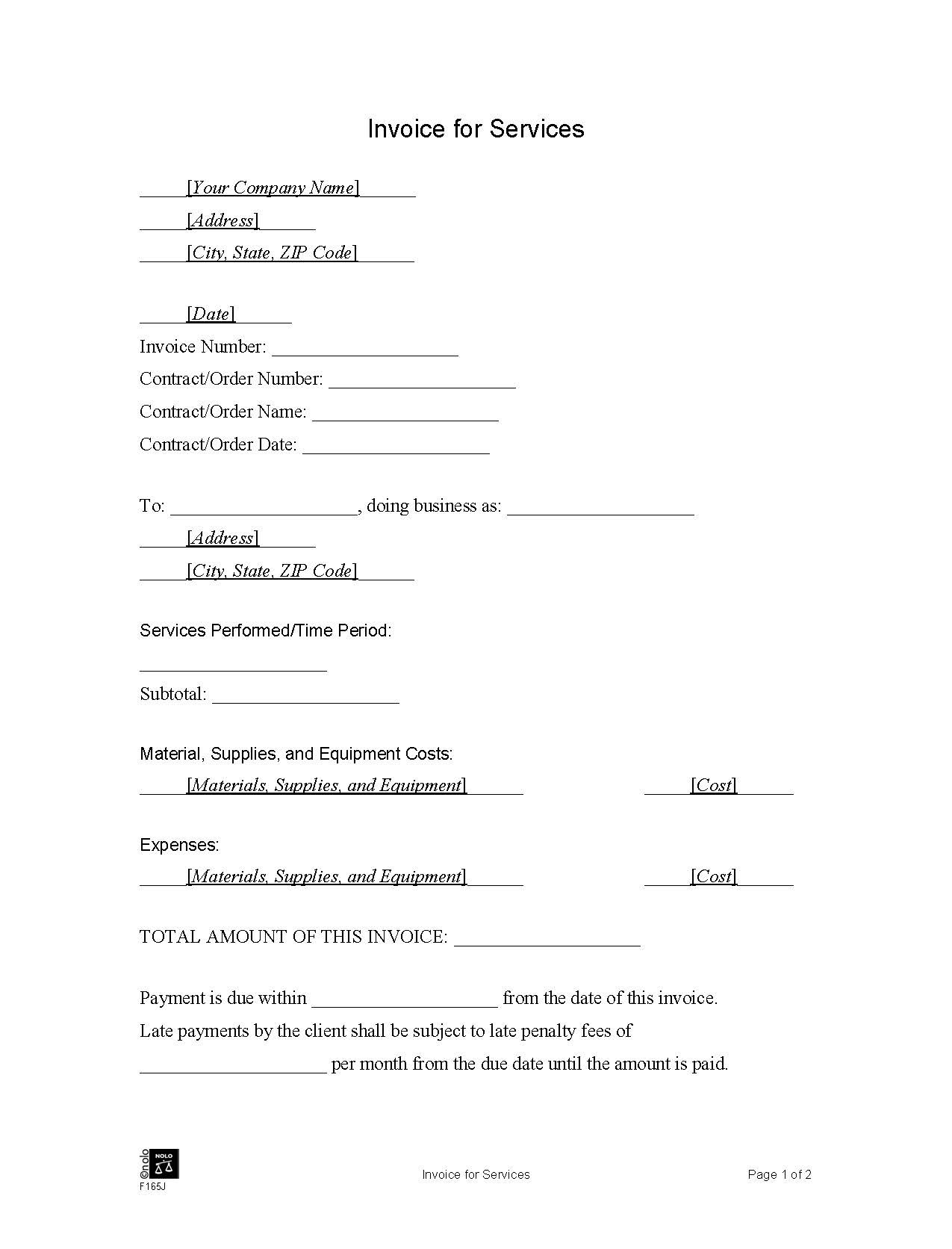

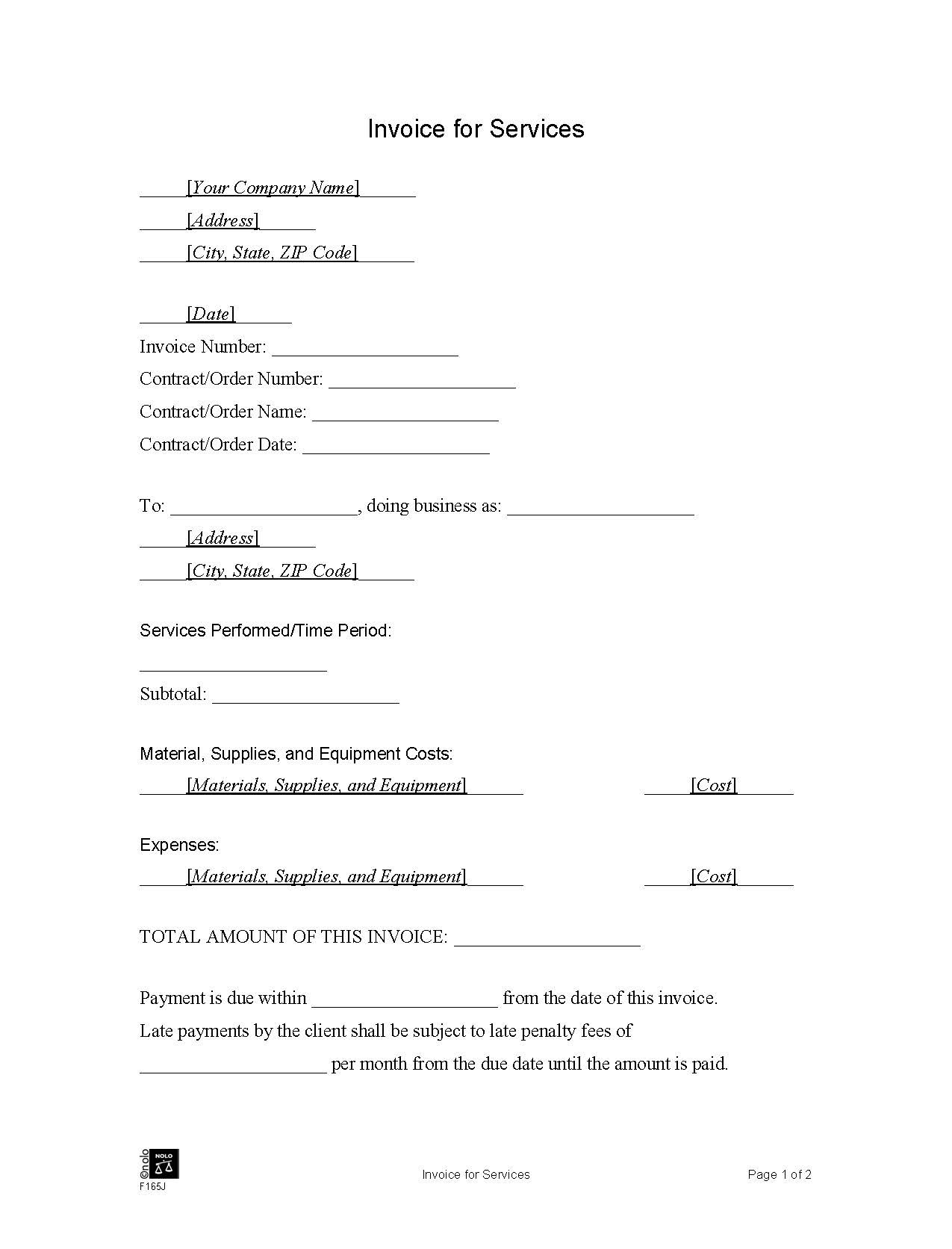

You can use the template available here (one of the many free invoice templates available online), or you can purchase an invoicing system or create your own invoice. Whichever method you choose, you'll want to include the following information in your invoice:

A heading that identifies your company. If your company has a logo, it should appear at the top of your invoice along with your name, company name, address, phone number, email address, and website address if you have one. It's a good idea to use a font and size that makes this information stand out so that the person who receives your invoice can easily identify it.

Your client's name and contact information. As discussed earlier, addressing your invoice to the right person and department can be key to getting paid quickly. Use a specific person's name and department, whenever possible, along with the mailing or email address and a phone number.

The date of the invoice. The date you sent the invoice will usually be different from the date you completed the work, but you'll need the date the invoice was prepared because it marks the start of the time period that you've allowed for payment.

Payment due date. It's a good idea to include the payment due date right below the date the invoice was prepared so that your client readily sees it. You can include incentives for paying early and consequences for paying late near the end of the invoice, as you'll see in the payment terms section below.

The invoice number. Assign a separate and unique identifying number to each invoice you send--even if you are invoicing a company you have invoiced before. Choose a numbering system that will allow you to number each invoice consecutively. You can start with the number, "1" or choose a numbering system that shows your optimism about your new business. For example, you might choose to number your first invoice "001" to build in the possibility of issuing hundreds of invoices as your business grows. In this example, your tenth invoice would be numbered 010; your one-hundredth invoice will be 100 and so on. Including the current year in the invoice, such as 2021-1, is another way to number invoices.

The purchase order number ("PO") if one was provided. When the company you are working with uses purchase orders (a document issued by buyers that details the items to be purchased), include the P.O. number on your invoice.

A description of services provided. The description of services provided should match the description used in the service contract. Your description should be concise, but it should also be complete and itemized so it's easy to see the breakdown of services and the charges for each. For example, a website designer would include the number of pages and the titles of each page created. If the designer also bought or provided photography or other artwork such as graphs, those items should be listed on a separate line. When charging hourly for assignments, itemize the number of hours worked and the hourly rate. For example, if you worked 20 hours and your fee is $50 per hour, your description would include a line that reads, "20 hours at $50 per hour."

The total due. The way you list the total due will depend on what was negotiated at the outset. If your assignment includes several components with a separate fee for each, such as the example above of the invoice for the web designer, you would list the development of web pages with the charge for that service on one line, the artwork you bought or developed with the charges for that service on a second line, and add up the two charges as the total due on a third line. If you agreed to a flat rate for the project, your invoice would list that amount at the end of the services breakdown.

If you've previously received a deposit, make sure you list it as a separate item and deduct it before you enter the total due.

Payment terms: This can be a simple statement, such as, "Payment is due 30 days from receipt," or a list of the incentives you are offering for paying early and fees you will charge for paying late as described earlier.

A thank-you note. Always end your invoice with a note of thanks to show that you appreciate the business.

When and How to Send an Invoice

It's customary to send the invoice when you've completed the work. You might also consider a monthly invoicing cycle for long assignments performed over several months or more. Here too, you'll want to first have a conversation with your client about the billing cycle you use and the way you allocate the fees. When freelancers haven't yet established a relationship with a client, they sometimes send the invoice along with the signed client service agreement. But sending the invoice at so early a stage can pose problems when the work you're asked to do or materials you're asked to use change over the course of the assignment. Keep in mind too that some clients might not look favorably on getting an invoice before the work is completed, and doing so might actually jeopardize your efforts to build a relationship.

If you choose to send your invoice upon completion of the work, make sure you do so promptly. Waiting weeks or longer before sending an invoice sends a message that collecting your fees isn't a priority, and if the delay is long enough, the client might forget about the work that was done or worse, spend the budgeted money on something else!

It's customary to send invoices by e-mail in today's world. If you've created your invoice in a word document, you'll want to save it to a PDF format before sending so that it can't be altered.

What to Do Once You've Sent the Invoice

It's important to set up a system that allows you to record prompt payments and follow up on late payments promptly. Keeping your invoices together in a computer file organized by date can help alert you when payments are past due. Automated invoicing systems like QuickBooks have built-in reminder features.

If a due date arrives and you haven't received payment, you should act promptly by calling the client or resending the invoice, marked "past due," or, for a softer touch, "Have you forgotten? Your payment is due now."

Your relationship with – and knowledge of – the client will usually help you decide how many reminders to send before taking additional action.