Learn when the government may take all or part of your income tax refund to collect overdue child support, what you can do to avoid that outcome, and how you can get some of the money back if you’re the current spouse of a parent who owes back support.

If you owe child support but are behind on your payments—or haven't been paying at all—federal and state agencies and courts in the United States have several ways of collecting the overdue support (sometimes called "arrears" or "arrearages"). Among those tools is what's known as the Treasury Offset Program (TOP), which can take all or part of your federal income tax refund to cover the child support arrears. Read on to learn how the offset works.

- How Does the Tax Refund Offset for Child Support Work?

- How Will You Know When Your Tax Refund Will Be Applied to Child Support?

- What To Do When You Receive Notice of a Tax Refund Offset

- What If the Refund on Your Joint Return Was Taken for Your Spouse's Child Support Debt?

- Can State Income Tax Refunds Be Intercepted for Overdue Child Support?

- What Else Can Happen If You Don't Pay Child Support?

- What To Do If You're Owed Child Support

How Does the Tax Refund Offset for Child Support Work?

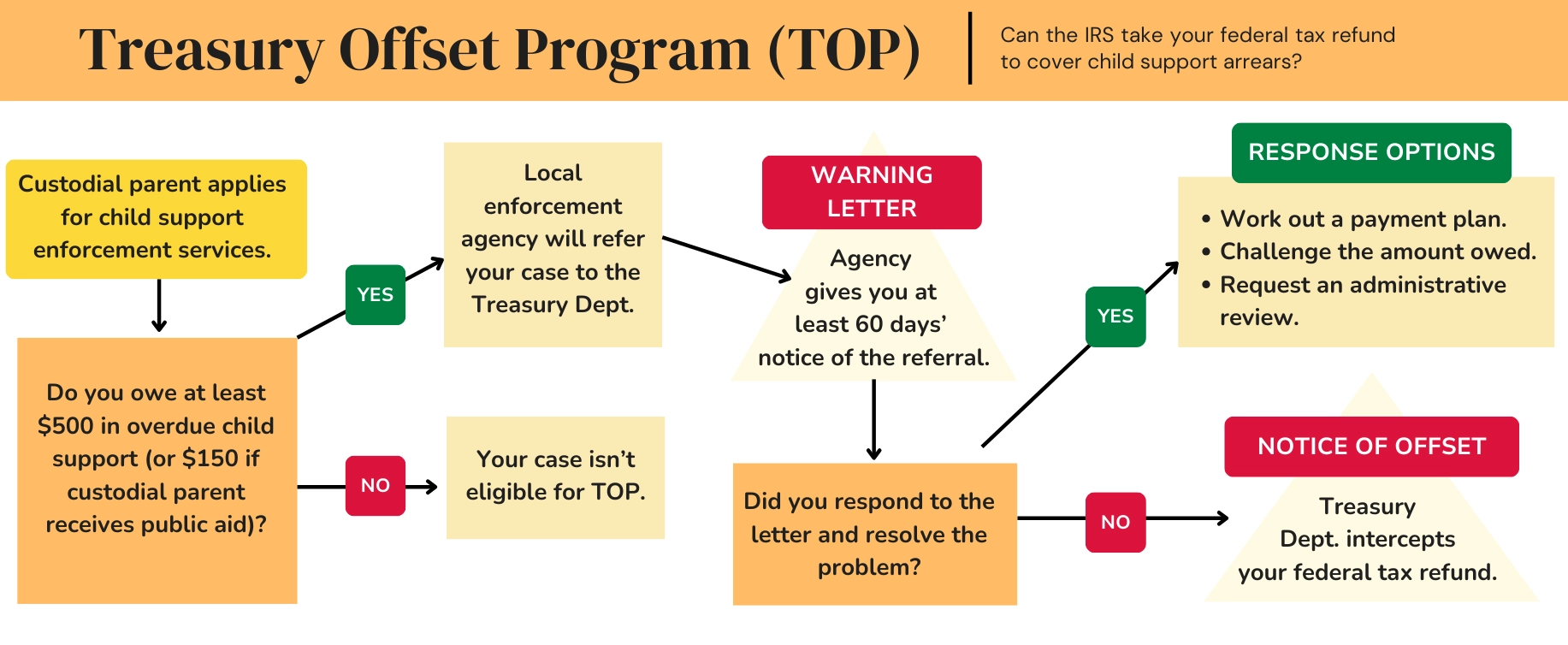

As part of a federal-state child support enforcement program, all states have agencies that collect and enforce child support. (The program is also available in Washington, D.C., certain territories, and 60 tribal nations.) The local agency will take steps to collect the support and keep track of the payments after a parent who is supposed to be receiving child support (usually the parent with primary physical custody of the child) applies for enforcement services. (Child support agencies automatically handle cases when the custodial parents are receiving public assistance on behalf of the children, such as TANF.)

Under the criteria for the TOP, the local agency will send a case to the Treasury Department when a parent owes at least $500 in child support arrearages (or $150 if the custodial parent is receiving public assistance).

Then, if the noncustodial parent is due to receive a tax refund, the IRS has the authority to take the amount of overdue support out of the refund and forward it to the child support agency. This means the parent may receive a partial refund or none at all—depending on how much they owe and the original refund amount. (I.R.C. § 6402(c), 42 U.S.C. § 664 (2025).)

How Will You Know When Your Tax Refund Will Be Applied to Child Support?

You'll receive two different notices in the mail if your child support arrearages meet the requirements for the tax refund offset (discussed above):

- At least 60 days before referring your child support debt for the offset program, the child support agency will send you a letter warning you that it plans to do that and telling you how much you owe.

- Then, if you haven't resolved the problem and are due to get a tax refund, you'll receive a "Notice of Offset" from the Treasury Department to let you know that your refund has been intercepted.

Be forewarned that the child support agency may not issue a new notice every time the amount of overdue child support changes. That means the amount shown on the pre-offset notice might be different than the amount the IRS ultimately takes from your refund.

What To Do When You Receive Notice of a Tax Refund Offset

If you receive a pre-offset notice from a child support agency, the letter will explain your rights for resolving the problem—including how to work out a payment plan, challenge the amount the agency says you owe, or request an administrative review of your case. Don't ignore this notice—contact the agency immediately and take appropriate action. (The contact information should be included in the letter.)

Unless there's been a mistake and you don't owe the minimum overdue child support for the tax refund offset (as discussed above), the only way to avoid having your tax refund intercepted is to sign a payment agreement with the agency and begin making payments.

If you no longer can afford to pay the amount in your existing child support order because of a change in your financial circumstances, you may request a child support modification. Ask the child support agency if they'll review your case to see if you qualify. Otherwise, you can seek a modification directly in court. But even if you're successful in lowering your child support obligation, the change generally won't apply retroactively. That means you'll still have to pay what you previously owed in back support—or have the amount taken out of your tax refund.

What If the Refund on Your Joint Return Was Taken for Your Spouse's Child Support Debt?

If the IRS will (or already has) offset the refund from your joint tax return for overdue child support that your spouse owes—such as for children from a previous marriage—you can request your share of the refund back. You'll need to file Form 8379 with your original joint tax return, an amended joint return (if you're claiming a joint refund), or by itself after you've received the notice of the offset. As a general rule, however, you must file the form within the later of:

- three years after the due date of the original joint tax return, or

- two years after you paid the taxes that were offset for your spouse's child support debt.

You can download Form 8379 and full instructions from the IRS page on Injured Spouse Allocation.

Be sure to follow all of the instructions carefully. If you're filing the claim with a joint return, enter "Injured Spouse" in the upper left corner of the return's first page. (Don't confuse "injured spouse" with "innocent spouse," the IRS's term for taxpayers who might get relief when they didn't know their spouse understated taxes on a joint return.)

If you live in one of the community property states, there are special rules for calculating your injured spouse refund. The IRS will use the rules for your state to decide how much you might get back.

According to the IRS, the processing time for these claims is generally about:

- 14 weeks if you filed Form 8379 with a joint return on paper

- 11 weeks if you filed the form with a joint return electronically, or

- eight weeks if you filed Form 8379 by itself after your joint return has already been processed.

If you haven't received a response to your claim or your correct refund, you can try calling the IRS at 800-829-1040 (or the number for your local IRS office). But you may want to speak with a tax professional (such as a certified public accountant or a tax attorney) for advice and help with the claim form or getting an injured spouse refund.

Can State Income Tax Refunds Be Intercepted for Overdue Child Support?

Some states that have income tax (such as California and South Carolina) may also take parents' state tax refunds for overdue child support. Generally, these state programs are similar to the federal TOP (described above). However, they may have different criteria for when the offset will kick in—that is, how much parents must owe in back child support before their state tax refunds will be intercepted.

Like with a federal offset, you should receive notices from the child support agency and the state tax agency about any offset of your state tax refund for child support arrearages.

What Else Can Happen If You Don't Pay Child Support?

Federal and state governments are actively involved in enforcing child support orders. Local child support agencies will automatically get involved whenever custodial parents are receiving public assistance on the child's behalf. In other cases, the agencies will step in when custodial parents request their services (more on that below).

In addition to referring a child support debt for a tax refund offset, these agencies have several other ways of collecting overdue child support. Depending on the specifics of your case—including how much you owe—you could face any of the following enforcement actions:

- Under an income withholding order (sometimes called an earnings assignment order or an income deduction order), a certain amount is automatically taken out of your paychecks for the child support arrearages, as well as your current support payments. Income withholding orders can also apply to other regular income you receive, such as unemployment benefits, workers' compensation, disability benefits, veterans' benefits, and annuities.

- Your driver's license, professional license, or recreational license (or all of those) may be suspended or revoked until you pay off the child support debt.

- The child support debt may appear on your credit report, which could hurt your credit rating and make it difficult to borrow money.

- A property lien may be placed on your home, car, or certain other types of property, so that you can't sell or refinance until you pay off the debt

- Your bank account and other financial accounts may be frozen until you pay off the debt.

- In some situations, certain types of property you own could be seized.

You could also face fines or jail time for unpaid support, as a result of:

- court proceedings to have you found in contempt for willfully failing to obey your child support order, or

- in extreme cases, criminal charges under federal law or some state laws.

What To Do If You're Owed Child Support

If your child's other parent is late with the payments you're owed under your child support order—or hasn't been paying at all—you must have an active case with a child support enforcement agency before the overdue support can be collected through an offset of your ex's income tax refund.

You'll need to enroll or apply for services to open a case with your state or tribal child support agency unless the agency is already handling your case—for instance, if you applied for child support through the agency rather than as part of your divorce, or you're receiving public assistance on your child's behalf. There's a one-time enrollment fee of $25, as well as an additional annual fee of $35 that kicks in when the agency collects at least $550 for you. (These fees don't apply to parents who are receiving public assistance.)

Under the Uniform Interstate Family Support Act (UIFSA), child support agencies can enforce your support order even if your child's other parent has moved out of state. (They can also help locate your ex when that's needed.) If you're the one who has moved to a different state after your divorce, the local agency should be able to help you register the out-of-state child support order so that it can be enforced in the state where you live now.

Once the agency opens your case, it will automatically notify the IRS after the amount of unpaid child support hits the threshold for offsetting your ex's income tax refund (discussed above). You generally won't have to do anything else to receive the money. However, if the agency's collection efforts haven't produced any results or are simply taking too long, you may want to contact a family law attorney who can help you enforce your child support order in court.

- How Does the Tax Refund Offset for Child Support Work?

- How Will You Know When Your Tax Refund Will Be Applied to Child Support?

- What To Do When You Receive Notice of a Tax Refund Offset

- What If the Refund on Your Joint Return Was Taken for Your Spouse’s Child Support Debt?

- Can State Income Tax Refunds Be Intercepted for Overdue Child Support?

- What Else Can Happen If You Don’t Pay Child Support?

- What To Do If You’re Owed Child Support