Filing appeals or qualifying for exemptions might help you reduce your Florida property tax bill.

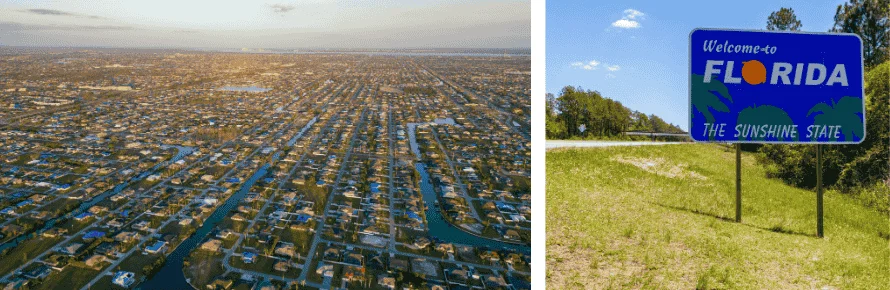

As a Florida homeowner, you are probably well aware that your house and land are subject to local property taxes. For many residents of the Sunshine State, property taxes represent a significant part of their financial burden. Of course, you want to ensure that you are not overpaying. So how might you lower your property tax bill?

There are two primary methods of reducing your Florida tax burden, including:

- filing an appeal (available to all homeowners), and

- if you meet certain qualifications, claiming tax breaks articulated within Florida's laws.

(See Florida Statutes § 194.011(2).) If you meet any of those qualifications, you may seek tax relief using both methods. We'll discuss both here.

Method #1: Appeal the Taxable Value of Your Florida Home

Florida authorities compute homeowners' property tax by multiplying the home's taxable value by the applicable tax rate. A property appraiser is supposed to physically inspect one's property at least once in every five years.

For example, imagine that the tax appraiser has placed a taxable value of $200,000 on your home. If the tax rate is 1%, you will owe $2,000 in property tax. You could, if that seems excessive, contest the $200,000 taxable value of your home, claiming that it's not worth that much. You'd need to back up by evidence, of course.

Your first step can be an informal conference with the property appraiser's office. Perhaps you'll show that nearby, comparable houses are worth less. Or perhaps something has changed; for example a neighboring vacant lot has been turned into a three-story condominium unit that puts your house into constant shade. Be sure to supply any relevant documentary evidence and photos. You can also ask that the appraiser visit your property in person for a look. (Florida Statutes § 193.023.)

If you live in a condo or other unit in a community governed by a cooperative association or homeowners' association, the community's governing board may file a single appeal petition on behalf of property owners, so long as their units or parcels are substantially similar when it comes to location, proximity to amenities, number of rooms, living area, and condition.

If you (or your homeowners' association) doesn't convince the Florida property appraiser's office, you can go up a level and file a more formal appeal, asking the Value Adjustment Board (VAB) to reduce your home's taxable value. If they took it down to $150,000, for instance, you'd owe only $1,500 in property taxes.

The Florida Department of Revenue offers guidance to homeowners seeking to contest their property tax assessments.

Method #2: Claim All Tax Breaks to Which You're Entitled

Florida allows for reduced property taxes if the homeowner meets certain requirements. The chief programs in Florida are summarized here.

- Primary home (homestead): If you own a house in Florida as your permanent residence, you might be entitled to a property tax exemption, known as a "homestead exemption," of up to $50,000. The first $25,000 applies to all property taxes, including school district taxes. The additional exemption up to $25,000 applies to the assessed value. The precise amount of the exemption depends on the assessed value of the home. (See Florida Statutes § 196.031.)

- Construction for older family member: If you construct living quarters in your home or on your property for a parent or grandparent (natural or adoptive) who is at least 62 years old, and that person actually continues living there, you can apply (annually) to either have the added value of your property be made exempt from property tax, or to have 20% knocked off the total, whichever is less. (See Florida Statutes § 197.703.)

- Exemption for longtime resident, limited-income seniors: If you are 65 years old or older, and have had a permanent Florida residence for at least 25 years, you might be entitled to a 100% exemption. Your eligibility for this exemption depends on the county or city where you live, and your income must be below a specified limit. This exemption applies only if your home is worth less than $250,000. (See Florida Statutes § 196.075.)

- Deployed service member: If you were deployed in U.S. military service during the tax year, you may qualify for an additional homestead exemption. The exact amount depends upon how many days you were deployed. (See Florida Statutes §196.173.)

- Surviving spouse of person killed in military service: There's a homestead exemption if you are the surviving spouse of a military person who died from service-connected causes. (See the "Fallen Heroes" Act, Florida Statutes § 196.081.)

- Surviving spouse of first responder. There's also an exemption if you were married to a first responder who was killed in the line of duty. (See Florida Statutes § 196.081.)

- Disabled veteran. In addition to the usual homestead exemptions, you may qualify for a tax discount if you're 65 years old or older, and have a disability that's wholly or partly due to combat. (See Florida Statutes § 196.082.)

- Disabled veterans who must use wheelchairs. If you are an ex-servicemember who was honorably discharged with a service-related total disability, are receiving or have received financial assistance due to disability requiring specially adapted housing, and you are required to use a wheelchair for transportation, you can claim exemption from property tax. (See Florida Statutes § 196.091.)

- Other disabled people. If you're blind, need a wheelchair for mobility, or are totally and permanently disabled, you might qualify for a total exemption from Florida property taxes, if your household income is below a certain level. (See Florida Statutes § 196.101.)

- Totally and permanently disabled first responders. If you have a total and permanent disability as a result of injuries sustained in the line of duty or a cardiac event caused (within 24 hours) by nonroutine stressful or strenuous physical activity in the line of duty, and this occurred while you were serving as a first responder in Florida or during a Florida-authorized operation in another state or country, you can claim exemption from property tax. A surviving spouse who has not remarried can also claim it. (See Florida Statutes § 196.102.)

Contact your local tax appraiser for complete details on these and other Florida exemptions, including any required forms you need to complete and the deadline for filing initial or subsequent claims. For contact information for the tax appraiser's office in your county, see the website of the Florida Department of Revenue.

Getting Legal Help

Property taxes are not always straightforward, as you can probably appreciate from this short article. Depending on the complexity of your situation, you might want to seek help from a Florida property lawyer.

Talk to a Lawyer

Need a lawyer? Start here.

How it Works

- Briefly tell us about your case

- Provide your contact information

- Choose attorneys to contact you

- Briefly tell us about your case

- Provide your contact information

- Choose attorneys to contact you