Substantial gainful activity is the level of work that a person without a disability can do.

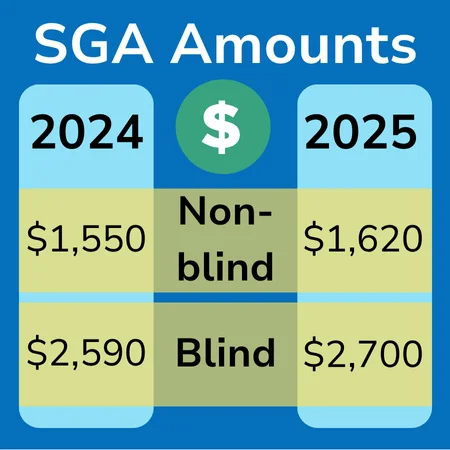

One of the basic requirements for obtaining Social Security disability benefits is that you're not engaging in what the agency calls "SGA." SGA stands for "substantial gainful activity," which is defined as a specific dollar amount that represents the point at which your monthly earnings are considered to be "working full-time." For 2025, this amount is $1,620 per month ($2,700 if you're blind).

Social Security defines disability as being unable to work full-time for at least one year due to a medical condition, so you'll need to show that you have at least a 12-month period where you aren't earning at or above SGA—otherwise, your application will be denied. Because substantial gainful activity is such an important part of Social Security law, you should become familiar with what it means and how it affects your disability claim before you apply for benefits.

- What Does Substantial Gainful Activity Mean?

- What Counts As "Substantial"and "Gainful" Activity?

- How Is Substantial Gainful Activity Calculated?

- Substantial Gainful Activity Exceptions

- Income Exclusions That Can Keep You Below SGA

- Other Types of Income That Aren't Considered SGA

- What Happens If You Go Over the SGA Limit?

What Does Substantial Gainful Activity Mean?

Substantial gainful activity is generally a pretty straightforward concept—if you're making more money than the monthly SGA limit, Social Security can't award you disability benefits. It doesn't matter if you earn the entire $1,620 in one week and are bedridden for the rest of the month, for example. Whether or not you have income at or above the substantial gainful activity threshold is the first step in Social Security's five-step sequential evaluation process, and the agency can't proceed further if you're earning SGA.

Social Security adjusts the numerical dollar amount considered "substantial gainful activity" every year to account for increases in the cost of living. The agency usually announces the increase in October prior to the year the adjustment will take effect, but the actual SGA amount won't change until January 1 of the next calendar year. The below graphic visualizes the increase in SGA between 2025 and 2024, as an example:

SGA can be more than just a number, however. Doing volunteer work, running a small business, and even criminal activity can all be considered substantial gainful activity—even if you're not making any money.

What Counts As "Substantial"and "Gainful" Activity?

To understand how Social Security decides what substantial gainful activity is, it helps to break down the term into its component parts.

- Substantial activity involves significant physical or mental effort. Work can be substantial even if you do less, get paid less, or have less responsibility than jobs you've held in the past. (20 C.F.R. § 404.1572 (a))

- Gainful activity is anything you do for pay or profit. Even if you don't actually get paid, work can still be gainful as long as it's the type of work people usually get paid to do. (20 C.F.R. § 404.1572 (b))

Here's an example of a case where Social Security might determine that a disability applicant in 2025 is working at the level of substantial gainful activity, even when they're earning less than $1,620 in a month:

As shown in the above example, even if you don't get paid for your work, Social Security can still conclude that your activity counts as substantial gainful activity or shows that you have the ability to work at the SGA level.

How Is Substantial Gainful Activity Calculated?

Disability applicants who are involved volunteers are sometimes surprised to learn that their "work-like" activity can count as SGA. Examples of situations where Social Security might calculate volunteering as substantial gainful activity include:

- if you were paid for what you do, your wages would be above the SGA level

- you spend more than a few hours a week volunteering

- the volunteer duties have physical or mental requirements that suggest your ability to work at the SGA level, and

- you're volunteering for a business that is owned by a family member.

The more your volunteering resembles work, the more likely Social Security will find it to be substantial gainful activity. For example, if you volunteer at a library stocking shelves for 20 hours a week, the agency can take into consideration the physical demands of the job (such as carrying and shelving books) as well as the significant number of hours worked (half of a normal workweek) to determine that the volunteer position should be counted as SGA.

If you're self-employed—doing contract ("gig") work, odd jobs, freelancing, or running a small business—Social Security uses one of two special formulas to calculate whether your work is substantial gainful activity. These formulas are called the "Countable Income Test" or the "Three Tests." You can learn more about how these tests are applied in our article on disability benefits for the self-employed.

Substantial Gainful Activity Exceptions

Not everything that a person could earn money doing will count as substantial gainful activity for Social Security purposes. Here are some examples of activities that the agency usually doesn't consider to be SGA:

- things you do to take care of yourself, such as taking a shower or getting dressed

- household chores, like doing the laundry or sweeping the floor

- physical, occupational, or mental therapy

- going to school, and

- involvement in social activities, such as a book club or church group.

Volunteer work for programs that are covered under the Domestic Volunteer Service Act of 1973 (42 U.S.C. 4950) is never considered SGA. Exempt programs include:

- Volunteers in Service to America

- University Year for ACTION

- Special Volunteer Programs

- Retired Senior Volunteer Program

- Foster Grandparent Program

- Service Corps of Retired Executives, and

- Active Corps of Executives.

Keep in mind that even though Social Security doesn't consider these activities to be SGA for the purposes of determining your initial eligibility for disability benefits, the agency may still consider them as evidence of your functional limitations. Your limitations are an important component of your residual functional capacity, a set of restrictions that Social Security uses to determine whether you're disabled.

Income Exclusions That Can Keep You Below SGA

Even if you're working, Social Security doesn't always count all of your earnings towards the SGA threshold. Such exceptions—known as income exclusions—are meant to encourage people who are trying to get back into the workforce. It's important to keep in mind that the substantial gainful activity amount is the same regardless of whether you're applying for Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI).

SSI Recipients

Because SSI is a needs-based program for people with low income and assets, Social Security excludes some income when determining whether they're engaging in substantial gainful activity so as to avoid penalizing people who are picking up some extra earnings to make ends meet. If you apply for SSI because you have limited resources, the agency won't count the following amounts towards the SGA threshold:

- the first $20 of unearned income

- the first $65 of earned income

- half of the remaining amount of earned income over $65

- the first $30 each quarter of income received on an irregular basis, and

- any money you save under a Plan to Achieve Self-Support (PASS) program.

Impairment-Related Work Expenses (IRWE)

Impairment-related work expenses, or "IRWEs," are costs you incur for special services or equipment related to your disability and that are necessary for you to work. If you've spent money on IRWEs, Social Security may deduct the cost from your earnings, which can help keep your income under the level of substantial gainful activity. Examples of IRWEs may include the following costs:

- paying for specialized transportation to and from work

- hiring someone to help you get ready for work in the morning

- hiring a non-impaired person to do a part of your job you can't do because of your disability, and

- training needed to learn how to use impairment-related specialized equipment needed for your work (for example, learning how to use a page turner or other typing device.)

To have IRWEs deducted from your earnings, you can't have already received reimbursement for them (for instance, from a vocational rehabilitation program). You also can't get IRWE deductions for payments for services needed on behalf of other people, such as childcare. Lastly, costs for IRWEs must be paid in cash and not by an exchange of services.

Subsidized Employment

Some employers pay disabled workers more than the market value of their labor in order to help them overcome employment barriers and gain experience in the workforce. Social Security refers to these situations as "subsidized" or "sheltered" employment. Any amount you're paid over the reasonable value for your services is considered a "subsidy."

Social Security won't include the amount of the subsidy when determining whether your work is substantial gainful activity. The agency uses multiple factors to determine whether earnings include a subsidy and to calculate the approximate value of the subsidy. This may involve contacting other employers in the same line of work or the Department of Labor to determine the usual wages paid for the job duties.

Other Types of Income That Aren't Considered SGA

In addition to the employment-related sources of income discussed above, other "passive" income sources aren't considered substantial gainful activity. Some examples include:

- money from investments or retirement funds

- VA disability benefits

- SNAP assistance (food stamps), and

- private long-term disability (LTD) or short-term disability insurance benefits.

While receiving passive income isn't considered engaging in substantial gainful activity, if you're applying for SSI, it's important to realize that passive income can still affect your eligibility for benefits if it puts you above the income limits for the program.

What Happens If You Go Over the SGA Limit?

That depends on when you go over the substantial gainful activity limit and for how long. If you're earning at the level of SGA when you apply for disability benefits (or you don't have a twelve-month period where you earned below SGA), your claim will be denied. However, if you tried to return to work after your alleged onset date but you weren't able to maintain employment, Social Security may consider the time you were earning above SGA to be an "unsuccessful work attempt."

Working when you're already receiving disability benefits is a slightly different matter. If you get a job and begin to regularly earn at or above the substantial gainful activity level, your benefits will eventually be terminated. People who are approved for SSDI have a nine-month "trial work period" during which you can engage in substantial gainful activity and still receive your full benefit amount, followed by a three-year "extended period of eligibility" that allows you to get benefits while earning below the SGA level. If you're approved for SSI, you can work up to the SGA threshold, but your SSI benefit will be reduced by how much you earned in that month, and you'll stop receiving benefits entirely if you go over the SGA amount.

For more information, see our articles on how much you can work while on SSDI and how much you can work while receiving SSI benefits.

- What Does Substantial Gainful Activity Mean?

- What Counts As “Substantial”and “Gainful” Activity?

- How Is Substantial Gainful Activity Calculated?

- Substantial Gainful Activity Exceptions

- Income Exclusions That Can Keep You Below SGA

- Other Types of Income That Aren’t Considered SGA

- What Happens If You Go Over the SGA Limit?